If you’re approaching an exit or a transition of your business, securing the right buyer is crucial. But how can you determine if the person across the table is actually the ideal buyer for your organization?

Knowing how to vet a potential buyer ahead of the transaction process is key. Before divulging any sensitive information, conduct your own reverse due diligence.

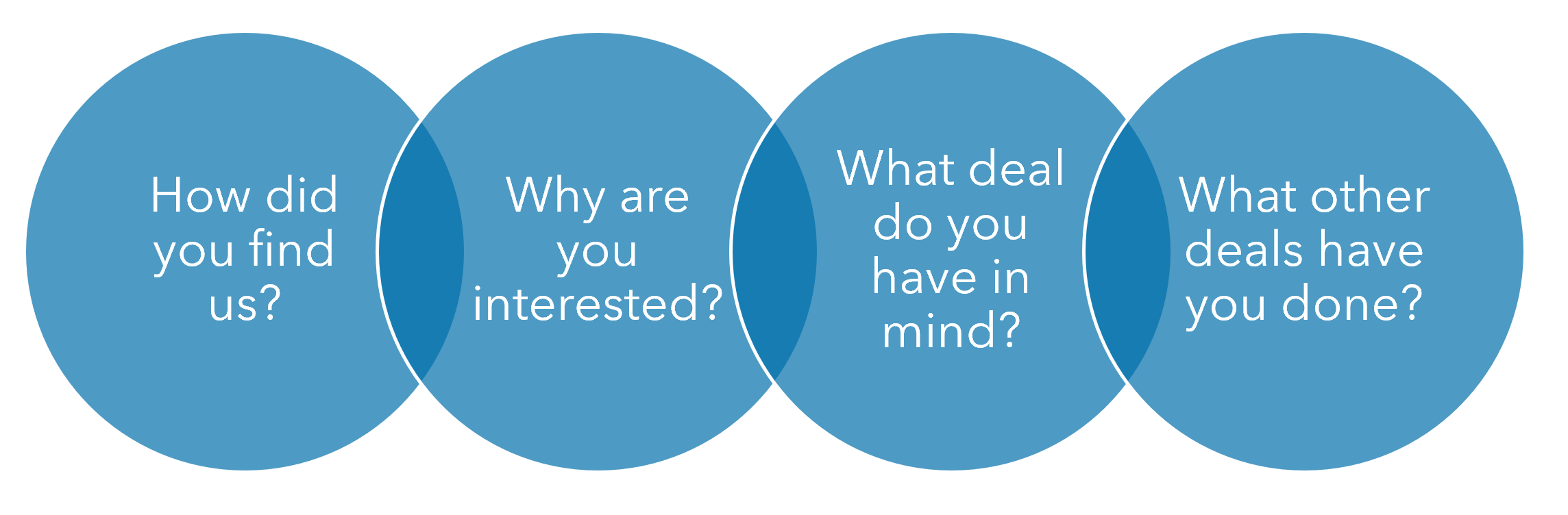

Asking these four questions can help you evaluate a potential buyer effectively so you can determine which interested parties are truly worth your time—and which ones aren’t serious contenders.

1. How did you find us?

It may seem like a pleasantry, but asking how a potential buyer found your company can reveal a good bit about their background, motivations and intentions.

Knowing the source that led a buyer your way can help you determine if they are genuinely interested in continuing the mission and vision of the organization that you’ve established, or if they are looking to turn a quick profit through a buy-and-flip.

If they found you through a reputable business broker or network, that may be an indication that they are actively looking to make an intentional, concerted investment in companies within your industry. On the other hand, if they came across your information through social media or advertisements, that may indicate a more spontaneous and impulsive approach.

2. Why are you interested?

Many business owners want a buyer to treat their business the same way they have treated it. Asking why a potential buyer has shown interest in your organization can help you discern how they’d lead it in the future.

Consider how the potential buyer’s values, strategies and plans compare with your own. If a buyer aligns with your values, it could facilitate a smooth transition and success for the organization into the future. But if not, it may lead to potential conflicts down the road for your current operations and employees.

If they express an interest in the potential for growth within your market, they may be able to offer new opportunities for growth in your business. However, if they are mostly interested in diversifying their own portfolio, this may indicate that they are unfamiliar with your industry and may be susceptible to mishaps.

3. What terms do you have in mind, and how will you structure and finance it?

Transactions aren’t only about price, but it’s critical to gauge a potential buyer’s plan for the deal and their financial capability. Having a financially stable buyer significantly reduces the risk of financial complications during the transaction.

If your potential buyer has already considered a deal structure and offer when they initially reach out to you, that indicates they are serious and strategic about the deal. But if they haven’t considered details like payment structure and timeline, it can indicate that they may not be fully prepared, experienced or equipped to successfully execute a complex transaction.

At such an early stage in the transaction process, don’t focus so much on the overall purchase price as the overall structure of the transaction. It may be tempting to think about the dollar figures you’d get from the deal, but your goal at this point should simply be to ensure that the buyer will be able to fulfill their end of the deal financially.

4. What other deals have you done, and what experience do you have with businesses like ours?

Understanding a buyer’s track record and qualifications can help you assess their ability to successfully complete a transaction and integrate your business into their operations.

They may want to grow the business but have no idea how. Maybe their ideas have been tried and have failed before. Getting to know their strategies is imperative.

A solid history of successful acquisitions can demonstrate their expertise and reliability. On the other hand, a spotty success rate could indicate issues that may impact the success of your deal. However, it’s also important to consider the context. A newer buyer might not have a long history but could still bring fresh perspectives and innovative approaches. It’s essential to weigh all factors and gather as much information as possible to make an informed decision.

Additionally, a buyer familiar with your industry is more likely to understand your company’s opportunities and challenges, which is essential for post-sale success. Buyers lacking this knowledge may face operational missteps, strategic errors, and lower financial performance.

Learn More about Evaluating Potential Buyers and Exiting Your Business

There are many entities out there that want to buy businesses. Some are legitimate and credible, and others are not. Business owners who are anticipating an exit should be very careful to discern the two. Asking the right questions and then asking for proof can help.

If you’d like to learn more about evaluating potential buyers for your company, or if you’re interested in learning more about the exit process, contact your Warren Averett advisor directly, or ask a member of our team to reach out to you.

Back to Resources